ajr_images/iStock by way of Getty Photographs

Funding thesis

Reserving Holdings’ (NASDAQ:BKNG) outcomes for Q1 FY12/2022 highlighted optimistic administration commentary about gross bookings in April 2022 reaching pre-pandemic ranges. Regardless of such optimistic knowledge, the shares have reacted little. We imagine the price of dwelling disaster will hit vacation conduct negatively into H2 FY12/2022, slowing the tempo and scale of restoration. With consensus estimates trying too bullish, we charge the shares as impartial.

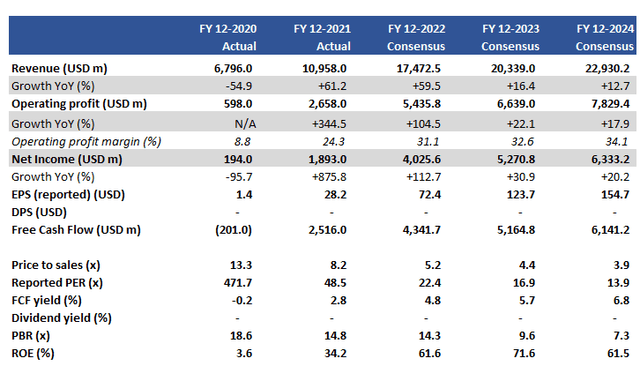

Key financials and consensus earnings estimates

Key financials and consensus earnings estimates (Firm, Refinitiv)

Our targets

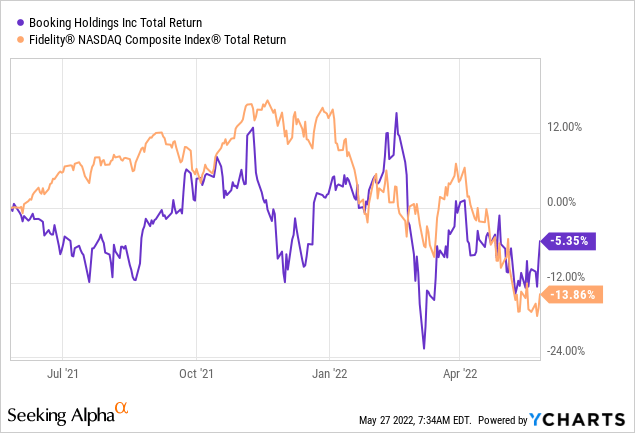

The loosening of journey restrictions submit COVID19 ought to herald a interval of sturdy demand for Reserving Holdings, coming within the type of pent-up demand from each enterprise and leisure vacationers. Reserving’s shares have outperformed the NASDAQ Index within the final 12 months however not by a really giant margin.

On this piece we wish to assess the next:

- Assess the extent of present demand for journey, and its outlook given the softer outlook in shopper sentiment.

- Revisit our promote suggestion from March 2021, considering consensus estimates for the subsequent two years.

We are going to take every one in flip.

Demand stays comfortable

The conclusion we come to is that sadly for the journey trade, demand presently stays softer than hoped. With many elements of the world going through a price of dwelling disaster, and the Russian invasion of Ukraine leading to a significant enhance in the price of primary items, we imagine it will have a big destructive impression on the longer term restoration of leisure journey.

We discover knowledge disclosed by the UNWTO (United Nations World Tourism Group) as one indication of the tourism trade’s well being. Though the info out there isn’t totally updated, their Tourism Recovery Tracker spotlight optimistic knowledge YoY within the restoration in journey sentiment and short-term rental demand for April 2022. Nonetheless, what stays deeply destructive YTD vary from precise air reservations down 70% YoY, lodge bookings down 69%, and low lodge occupancy charges at 58%. There may be proof of restoration elsewhere, as an example, Japan has seen a 1,185% YoY enhance in abroad vacationers in April 2022 however this stays down 95% from the degrees seen in pre-pandemic April 2019. The hurdle charges versus pre-COVID19 ranges are extraordinarily excessive.

The danger from rising prices will impression clients in addition to the hospitality commerce itself, which can also be going through rising enter prices in power, meals and wine, and payroll. A possible drop in provide can even be a destructive for journey websites as service provider volumes start to drop off.

Enterprise journey seems to be faring higher. American Categorical International Enterprise Journey (which is merging with SPAC Apollo Strategic Development Capital (APSG)) commented that the primary three weeks of April 2022 noticed transactions attain 72% of 2019 levels. There seems to be stronger momentum right here versus leisure with the company world returning to journey. The problem right here can be that with enterprise journey making up round 20% of the full market, the trade can solely be really saved with leisure volumes returning.

The consensus seems to be too bullish (once more)

In our earlier remark in March 2021, we felt that consensus forecasts have been too bullish, notably for enterprise journey restoration and we rated the shares as a promote. This time, we imagine consensus is as soon as once more being too bullish for the next causes.

For FY12/2022, we imagine the ‘bumper’ summer time of demand is unlikely to be sustainable. Within the outcomes name for Q1 FY12/2022, administration commented that at Reserving.com gross bookings for the summer time interval have been over 15% greater than on the identical level in 2019 – however a excessive share of those bookings have been cancelable and the reserving window had recovered (folks reserving forward have been much like pre-pandemic ranges, therefore have ample time to cancel). The important thing problem is over how sustainable this demand profile is versus a one-time restoration from pent-up demand. With the present macro setting, we can not envisage a gradual restoration that spills over into H2 FY12/2022.

What additionally appears too bullish is consensus estimating that the corporate’s annual revenues will hold recording double-digit progress into FY12/2023 (+16.4% YoY) and FY12/2024 (+12.7% YoY). Within the heady days of progress between FY2015-2019, the corporate grew gross sales by 13.0% YoY CAGR – we discover it very onerous to imagine that it might match such progress charges contemplating inflationary value pressures, falling requirements of dwelling, and better hurdles YoY.

The 2 present areas of weak point for the corporate are the Asia market and long-haul worldwide journey. With journey restrictions turning into lifted, there might be a surge in demand however the problem would be the charge of restoration in ADR (common each day charges) in lodging which can take a while. Additionally, on the earth of distant work, the necessity for enterprise journey has fallen which can have a long-lasting impression on worldwide journey quantity.

Reserving Holdings might purpose to extend market share to speed up topline progress, however we imagine the general market pie must develop for the corporate to carry out per consensus estimates. This doesn’t look more likely to us at this level.

Valuations

On consensus estimates (within the desk above within the Key Financials part) the shares are buying and selling on a free money stream yield of 5.7% for FY12/2023. That is a sexy yield and would place the shares within the undervalued class. Nonetheless, with consensus estimates showing too bullish we imagine a extra lifelike yield to be round 4%. Consequently, the shares look extra pretty valued.

Dangers

Upside danger comes from a sustained demand restoration in leisure journey as restrictions are lifted and shoppers start to allocate spending on holidays. The corporate has witnessed sturdy numbers in April 2022, and if such tendencies proceed the outlook is optimistic.

A comparatively swift finish to the Russian invasion of Ukraine will help in lifting shopper sentiment in addition to putting some downward strain on inflation (notably for agricultural meals costs).

Draw back danger comes from the rise in the price of dwelling which results in vacationers ‘buying and selling down’. The collection of lodging concentrates on decrease priced stock leading to falling ADR and revenues.

A protracted battle in Europe dangers getting different sovereign international locations getting concerned, which might place strain on the European journey market. The cancellation charge could enhance consequently.

Conclusion

Regardless of encouraging feedback from administration about current buying and selling, the corporate’s shares have reacted little. We put this right down to the market assessing the chance of a world recession and the destructive impression it will have on vacation conduct. While we anticipate a restoration for the enterprise, we imagine the tempo and scale might be slower and smaller than present consensus estimates. With market expectations being comparatively excessive, we now charge the shares as impartial.