The one narrative for the post-pandemic journey rebound that has largely stays in dispute now some two and a half years later, fueling prognostications from all sides, is the restoration of enterprise journey.

Simply as a flurry of recent late summer season forecasts for a full enterprise restoration hit — once more with no actual consensus — a narrative was gaining a whole lot of consideration that Google, as soon as the large of sending folks out on the street in a Google-outsized sort of a manner, was cutting back its travel budgets for what it known as solely “enterprise vital” journeys.

It was simply one other piece of proof for enterprise journey doubters that the business won’t ever be restored to its glory days. That’s as a result of after a difficult couple of years (and counting in some nations) the enterprise journey business has been wanting again, misty-eyed, to the higher instances of 2019, asking: When will or not it’s like that once more?

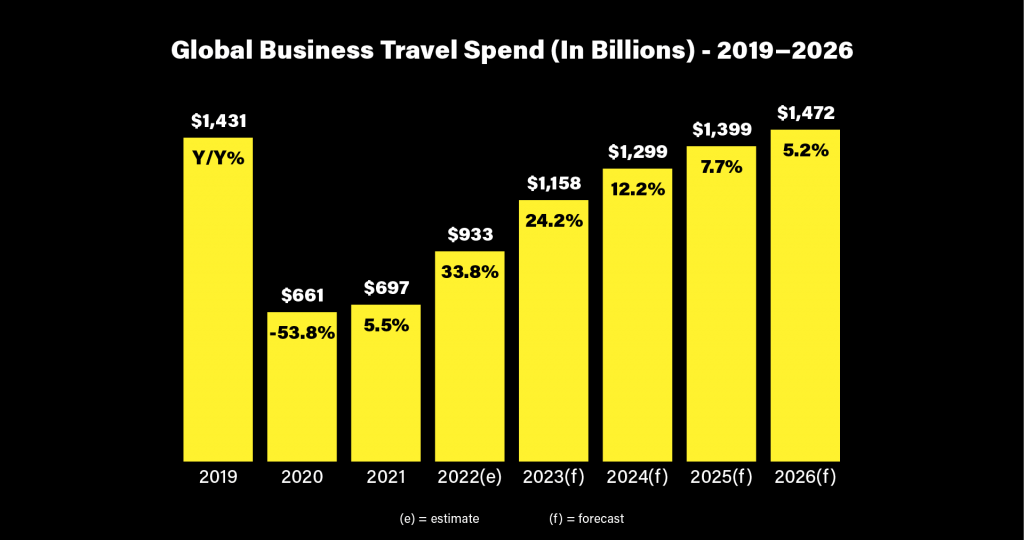

Extra particularly it’s been wanting again on the $1.4 trillion that was spent on enterprise journey, primarily based on the Global Business Travel Association’s calculations.

Everyone knows enterprise journey is a high-margin sport. Motels, airways and journey businesses have suffered following the extended absence of higher-paying company company. The trickle-down impact of these firm {dollars} and beneficiant expense allowances to native eating places, convention venues, taxi companies and others within the wider ecosystem additionally dried up.

What About That $1.4 Trillion Query

The $1.4 trillion determine has appeared extensively within the media, monetary studies and investor pitch decks for a number of years.

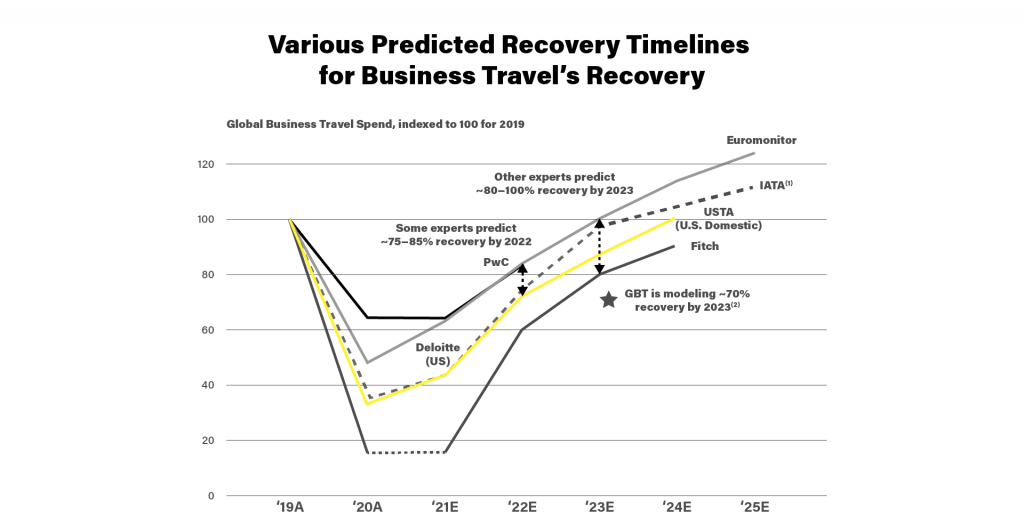

However the magic quantity’s been extra distinguished not too long ago as observers look to the top of summer season as a sort of coronavirus cut-off level, with new forecasts making an attempt to pinpoint precisely when this “restoration” will happen.

Earlier this yr, many individuals had been seeking to the autumn as a real take a look at for company journey’s resiliency as some doomsayers have stated it will never return to its former vibrancy.

“Autumn is convention season — a time that has grown in significance following the pandemic, as an more and more distributed workforce seems to be to take advantage of out of journey by assembly with colleagues, business friends, and purchasers to advance enterprise targets,” stated TripActions in its Fall Business Travel Preview.

The World Enterprise Journey Affiliation predicts the $1.4 trillion in spend will now return in 2026; there’s some option to go nonetheless contemplating the (comparatively) low base of $661 billion spent on enterprise journey in 2020, when Covid-19 was at its world peak.

That is the way it thinks it’s going to play out: an estimated $993 billion might be spent in 2022; $1.2 trillion is forecast for 2023; $1.3 trillion in 2024; $1.4 trillion in 2025; and $1.5 trillion in 2026.

Is Forecasting Even Related?

With so much global uncertainty impacting the enterprise of journey, together with inflation, the conflict in Ukraine, hybrid working and lots others, are forecasts nonetheless related?

Sure and no is the reply.

There’s nonetheless a necessity for that baseline, however on the identical time a lot has modified, and continues to vary, on the earth of labor, which by its nature impacts company journey.

“Any person has to forecast, I’m glad they’re doing it,” Katharina Navarro, a journey supervisor at a big consultancy and president of the World Enterprise Journey Affiliation in France, informed Skift.

In truth the return of enterprise journey demand has lengthy been among the most difficult sectors for CEOs to predict.

“Actually, if I am going out to ask consultants for information factors over the following three years, all people’s being very hesitant. No person needs to say. However a forecast is a forecast. If it adjustments, I adapt, I appropriate my assumptions. I really feel too many individuals now aren’t saying something, and that’s not useful.”

From a chicken’s-eye view perspective, forecasts are there to assist suppliers gauge future demand and markets, and journey administration corporations to handle assets. So sure it does matter, for instance, that Latin America is forecast to grow 55 percent this year.

And plenty of within the business do look to the affiliation’s annual outlooks, which it carries out with Rockport Analytics.

“Our view of the contribution to every country-sector mixture has been established by analyzing developments within the enterprise journey buying conduct of 44 sectors throughout 73 nations over a interval of greater than 20 years. By modeling developments of the extent of enterprise journey spending per greenback of business gross sales (a measure of enterprise journey productiveness) over time, we’re capable of prolong these elements into the long run,” it says.

Nobody else is ready to be as thorough, or distinguish between enterprise and leisure exercise, the affiliation claims.

“By and enormous, it’s quantity that’s the tide that we experience on this house,” stated Nick Vournakis, govt vp and chief buyer officer at CWT. “That’s how the availability chain evaluates different companies, and that’s how they assume.”

The place Are We Now?

As leisure journey visitors slows after summer season holidays, and faculties and workplaces reopen, all eyes are watching the info for enterprise journeys as an indication of issues to come back. A pure bounce is predicted as a result of that pent-up demand remains to be very a lot there.

The constructive developments for the primary three quarters of 2022 present a very good base for a clearer image 2023, in line with Man Snelgar, world enterprise journey director of the Advantage Travel Partnership.

“We’re seeing broad variations in company journey forecasts this autumn and winter,” famous Scott Davies, CEO of the UK’s Institute of Travel Management. “Whereas some organizations try to restrict journey to nicely beneath 2019 ranges resulting from financial uncertainty and rising prices, many corporations are enjoying catch-up by touring extensively to help each inner and buyer engagement.”

TripActions recognized a “comparable seasonal surge” in enterprise journey, regardless of considerations in regards to the macroeconomic surroundings. The startup company journey company has seen a sixfold year-over-year enhance in enterprise journey bookings with a begin date between September 1 and November 19, 2022, in comparison with an equal reserving window and journey begin date final yr.

After Labor Day within the U.S. it stated it had damaged its largest reserving and journey spend file, with a 28 p.c enhance week-over-week.

“There’s been a whole lot of consternation round this concept of September as a line of demarcation, as a result of it’s the top of the summer season holidays within the West. We see an amazing quantity of seasonality the place there’s typically a pure dip in enterprise journey in July and August, and a rebound from September to November,” added CWT’s Vournakis.

“We don’t count on this calendar yr to behave any in a different way than that, however the concept that there’s going to be a mass exodus beginning September 1, because it pertains to enterprise journey, I’m unsure we’ll see that come to fruition.”

As an alternative he predicts a wholesome resurgence with a progress curve that might be gradual however constant: “We’re on a restoration development, it gained’t get steeper.”

The Tough Job of Forecasting

Not everybody thinks the identical. “A lot of the annual 2022 journey finances expenditure has already concentrated within the first and second quarters of 2022, leaving difficult third and fourth budgets for the total yr of anticipated spend,” warned Paul Tilstone, managing accomplice of consultancy Festive Highway.

Nevertheless, if the one manner is up, now might be the most effective time to mirror on how enterprise journey is measured. The problem might be predicting which varieties of corporations will journey, how they do it and crucially why within the age of the Great Merging, the place work, journey and life generally.

The way forward for work developments and the nascent generation of digital nomads — long-term vacationers that dwell and work wherever, and have the potential to be a small and mighty traveler kind — is a vast-ranging topic itself.

However gathering new data, even up-to-the-minute developments, may assist the journey business regulate, react and get well maybe greater than charting patterns from the larger corporations.

A extra pressing matter is exploring the sizes of corporations now touring, for newer functions. Earlier than the pandemic they had been beneath the radar, but when bigger corporations do in the reduction of on journey in the long run, for sustainability causes or in any other case, they’re going to turn out to be a power to be reckoned with. (At an excessive micro degree, what sort of significance does subsequent technology hospitality firm Selina’s partnership with freelancer network Fiverr have?)

“The underside line is, we noticed a faster return to journey from the small and medium dimension market within the early elements of this yr, however we’re seeing equal quantities of restoration by way of slope and charge within the enterprise house now,” stated CWT’s Vournakis. “In truth, a few of our largest purchasers are outstripping the journey they did in 2019.”

Small companies most likely benefited from having fewer company laws and restraints. However as inflation and vitality costs creep up, there’ll possible be a swing of the pendulum this yr. “There’s extra wariness round managing the inflationary pressures that come together with this resurgence in journey demand. You’ll see extra sensitivity to that within the decrease finish of the market, in comparison with the upper finish,” Vournakis added.

However dimension issues, and company card and expense administration Ramp, which has raised $1.4 billion because it was based in 2019 and is seeing huge growth in travel, is looking for change.

“Everybody within the enterprise journey business has been speaking about managed journey for small and medium-sized enterprises without end. It’s by no means labored,” Ben Alderman, head of monetary, journey and accounting partnerships, informed Skift.

“Nobody has had any success, as a result of it simply doesn’t matter sufficient to (journey businesses) in the event that they’re spending $50,000 or $100,000 a yr on journey for them to handle that.”

Ramp’s expense platform permits corporations to set insurance policies, and Alderman stated spend was a lagging indicator, however coverage was a number one indicator. It June this yr its purchasers had made a mean 25 percent reduction in allocated employee travel budgets for the future, which may point out extra folks had been touring, and that the employer merely needed to rein issues in; journey, as a proportion of card spend, is growing at a double digit share.

There’s now worth in monitoring extra of those on-the-fly developments. “The info popping out of enormous corporates is herd conduct,” Alderman stated. “All of them are likely to do the identical issues, so you might have comparable suggestions and metrics out of the massive journey administration corporations. It’s very uncommon American Categorical World Enterprise Journey turns round and says one thing fully totally different to CWT. That simply doesn’t occur.”

He stated it’s price monitoring small and medium-sized enterprise conduct as a result of they’re such an enormous a part of the economic system.

“Conventional journey insurance policies have been thrown out the window since Covid,” he added, due to erratic journey prices. “Within the micro SME house, folks simply wanted to get again on the market once more, and the coverage they’d sat within the draw from two years in the past didn’t make sense any extra.”

Models, Not Volumes

It’s additionally time to boost the methodology.

One skilled journey supervisor, working for a big enterprise consultancy specializing within the pharmaceutical sector, stated that wanting again to 2019 fails to acknowledge that companies are in numerous sizes and shapes right this moment. In some instances, a lacking three years of progress needs to be factored in. The pandemic throttled most companies, however many sectors thrived in these darkish years, notably pharmaceutical and software program corporations.

“We quadrupled in dimension over the pandemic,” he stated, preferring to stay nameless. “The place most individuals may take a look at their return to journey ranges and monitor it by way of enterprise journeys, I didn’t need to try this and simply provide you with a quantity. We’ve clearly seen a (journey) progress charge resulting from the truth that our firm is so much larger than it was by way of headcount.”

Whereas journey spend had elevated, he eliminated the expansion component and calculated the proportion of workers who traveled within the first two quarters of 2019, versus those self same quarters in 2022. Somewhat than how a lot they traveled, how many individuals traveled?

The outcome was that his firm’s true “return to journey” determine was at 45.5 p.c of 2019, that means half as many workers had been touring for enterprise.

A New Period of Accountability

Additional forward, journey managers are predicting the way in which they perform their jobs change to mirror this modification in work.

Justifying the aim of journey in just a little extra particulars is changing into widespread, with Google one of many newest mega-companies to clamp down and ensure travel more “critical” than social.

With rising costs, there’s a renewed on information and a give attention to explaining the explanations for any will increase.

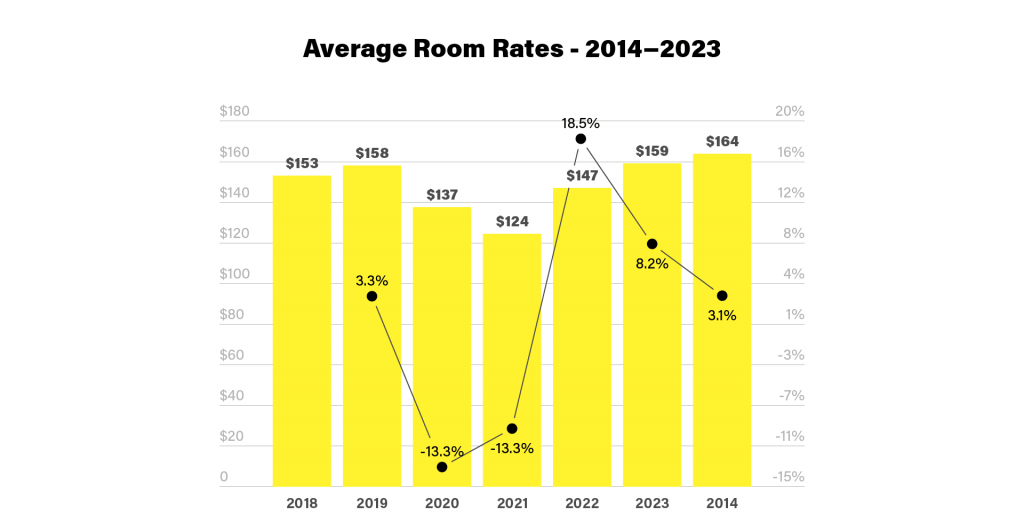

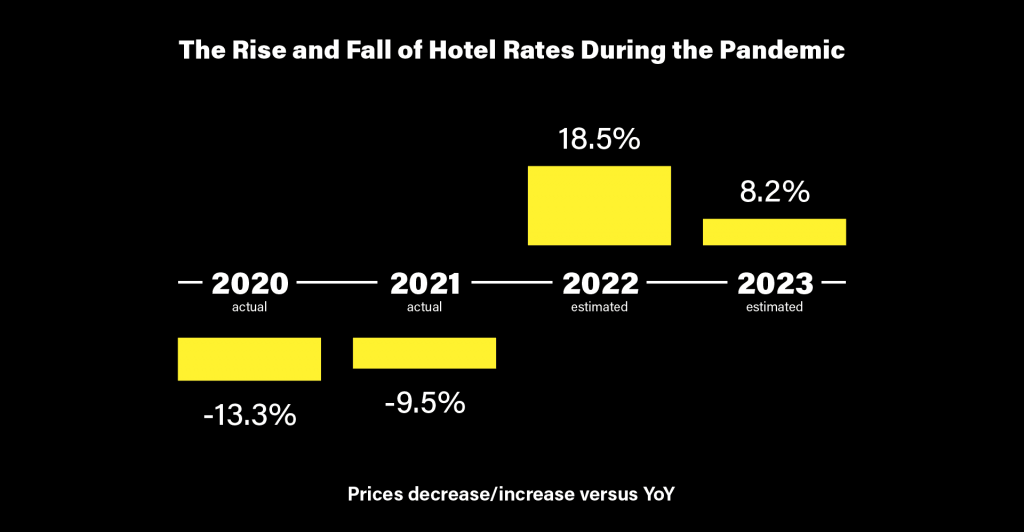

“As we’re coming to the top of the yr, we’re having negotiations with our suppliers proper now,” Navarro stated. “We’re attempting to grasp the affect of inflation on the totally different classes. There’s a typical understanding from finance that costs are going up, however the affect of procurement is to mitigate as a lot as we are able to to see how a lot of our program we are able to consolidate.”

She needs to higher perceive the breakdown. For air, how a lot is the gas element, how a lot is labor contributing, for instance. “For airways, I can see extra centralized information. It’s comparable between airways, however for resorts it’s very totally different, relying on the possession construction, model or location. I can see hesitation and pushback. You must watch out, some suppliers have tried to dump will increase over the previous couple of years. I’m assured of the costs I’ve proper now, however I don’t need to lose my aggressive edge.”

A current USA Right this moment article predicted hotel fees were now starting to change, with the following large cost set to be every day housekeeping charges. The earlier uproar was over resort charges, that are additionally set to make a comeback.

With accountability comes the accountants. Skift argued that “corporate travel is now in the firm grip of the CFOs,” however one journey supervisor, working for a U.S. primarily based TV manufacturing firm, stated it’s not so managed. With journey applications not fairly recovered, he’s seeing eye to eye much more as a result of ongoing hesitancy to travel.

“For workers, there may be an consciousness they don’t must journey,” he stated. “We sort of agree that is the best degree of spend. Vacationers on the entire are extra cautious and the disruption nonetheless continues. Journeys for inner conferences are simply not occurring, and execs are assembly quarterly or yearly.”

Don’t Name It a Restoration

This pure correction appears to be right here for the long run. One other journey supervisor, primarily based in Europe and dealing for a recruitment agency, stated his firm’s management had been coordinating upfront and mixing conferences.

“I don’t have the boldness enterprise journey goes to see the pick-up possibly that the business is hoping for,” he stated. “It’s going to be a gradual burn, it’s not prefer it’s a fast snapback to actuality after just a few months, which is what we thought at first.”

Additional forward, Navarro believes that sooner or later journey managers might be working with two currencies: the worth of the ticket, and the carbon affect of the ticket. Microsoft already charges itself an internal penalty based on the carbon emissions that its travel generates. With elevated scrutiny, extra corporates might discover their journey might want to shrink sooner than anticipated.

“We gained’t see it essentially in 2023, however the concept that there is likely to be carbon budgets to go together with spend budgets for journey will not be that far off,” agreed CWT’s Vournakis. “It’s very conceivable that the extra progressive corporates who lean into this may have clear carbon budgets beginning in 2024.”

Tilstone’s snapshot, like many others, is that the rest of 2022 gained’t set the demand agenda for the long run, with 2023 additionally set to stay in flux, as corporations that moved to distant verify what worth face-to-face brings, and when journey provides worth.

“I battle with the phrase restoration. Restoration means we’re going again to the place we had been earlier than. We’re not. We’re going into a brand new manner of touring, and managing journey, with extra give attention to sustainability,” Navarro stated. “It’s not a restoration, it’s a redesign of the business.”

Her sentiments echo these of workforce strategist Mattison, who informed delegates at World Enterprise Journey Affiliation conference: “I speak to a whole lot of leaders. There may be generally delicate, and generally not so delicate, ethos or mindset of: ‘We obtained by way of it (Covid), and now we are able to get again to regular,’” stated workforce strategist Seth Mattison on the World Enterprise Journey Affiliation conference in San Diego in August.

“I hate to be the bearer of dangerous information, however there may be nothing to return to. That world is gone. Why? As a result of now we have modified as folks, and now we have modified as a society. We modified the way in which we work and the way in which we create worth for our clients.”

His stated journey managers now performed such an vital position in shaping the experiences of their colleagues.

“And guess what, the way forward for work is altering the way forward for enterprise journey. We have now an opportunity to rethink, design and reimagine what this may appear like,” he stated.