Taking the occasional loss comes half and parcel with investing on the inventory market. Anybody who held Allegiant Journey Firm (NASDAQ:ALGT) during the last yr is aware of what a loser appears like. In that comparatively brief interval, the share worth has plunged 59%. Notably, shareholders had a tricky run over the long term, too, with a drop of 56% within the final three years. The falls have accelerated lately, with the share worth down 21% within the final three months.

With the inventory having misplaced 5.0% prior to now week, it is price looking at enterprise efficiency and seeing if there’s any purple flags.

Take a look at the opportunities and risks within the US Airlines industry.

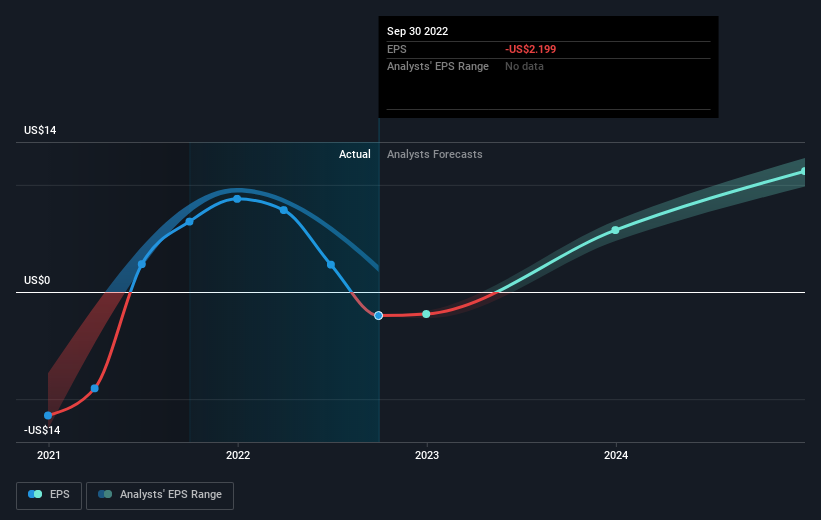

Whereas markets are a strong pricing mechanism, share costs replicate investor sentiment, not simply underlying enterprise efficiency. By evaluating earnings per share (EPS) and share worth adjustments over time, we are able to get a really feel for the way investor attitudes to an organization have morphed over time.

Allegiant Journey fell to a loss making place in the course of the yr. Whereas this may increasingly show short-term, we would think about it a unfavorable, so it would not shock us that the inventory worth is down. Nevertheless, there could also be a possibility for buyers if the corporate can get well.

The graphic under depicts how EPS has modified over time (unveil the precise values by clicking on the picture).

It could be properly worthwhile looking at our free report on Allegiant Travel’s earnings, revenue and cash flow.

A Totally different Perspective

Whereas the broader market misplaced about 19% within the twelve months, Allegiant Journey shareholders did even worse, dropping 59%. Having stated that, it is inevitable that some shares can be oversold in a falling market. The hot button is to maintain your eyes on the basic developments. Regrettably, final yr’s efficiency caps off a foul run, with the shareholders going through a complete lack of 8% per yr over 5 years. Usually talking long run share worth weak point could be a dangerous signal, although contrarian buyers would possibly wish to analysis the inventory in hope of a turnaround. It is all the time fascinating to trace share worth efficiency over the long term. However to grasp Allegiant Journey higher, we have to think about many different elements. Even so, bear in mind that Allegiant Travel is showing 3 warning signs in our investment analysis , and 1 of these is important…

After all Allegiant Journey will not be the perfect inventory to purchase. So chances are you’ll want to see this free collection of growth stocks.

Please word, the market returns quoted on this article replicate the market weighted common returns of shares that at present commerce on US exchanges.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Allegiant Journey is doubtlessly over or undervalued by testing our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your goals, or your monetary scenario. We purpose to convey you long-term centered evaluation pushed by basic knowledge. Observe that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.