The COVID-19 recession was born out of a public well being risk. Thus, unemployment insurance coverage (UI) was meant to insure individuals towards earnings losses related not simply with involuntary job loss, as in a common recession, but in addition with the selection to not work because of the public well being threat. Job losses had been dramatic and concentrated in lower-paid in-person service sectors similar to eating places, leisure and hospitality, and retail. UI was simply one in every of a wide range of insurance policies which offered direct help to house-holds, together with three rounds of Financial Influence Funds, debt forbearance, advance cost of the Youngster Tax Credit score, and lease reduction.

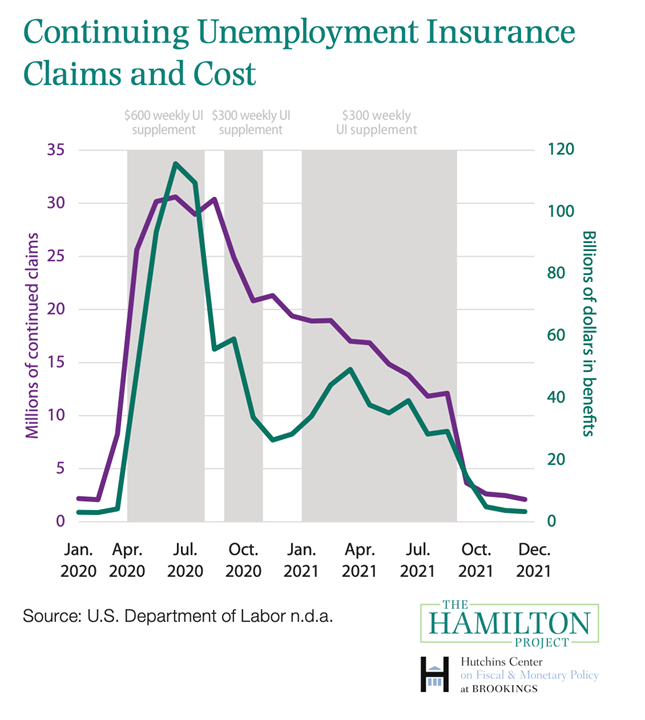

Previous to the pandemic, common UI changed simply 50 p.c of earnings in most states, and, as evidenced in low recipiency charges, many unemployed staff didn’t obtain UI advantages. In response to the COVID-19 pandemic, the U.S. authorities applied the biggest growth of federal UI advantages in U.S. historical past. It elevated the extent of advantages by means of weekly dietary supplements. Eligibility was expanded to incorporate impartial staff and people unable to work for a wide range of COVID-related causes by means of the Pandemic Unemployment Help (PUA) program. The period of federal advantages was prolonged by 53 weeks.

Proof on the COVID-19 Financial Coverage Response

What occurred when the U.S. gave extra individuals more cash, and for longer? UI protection elevated, reaching staff who had traditionally been not noted of the UI system, and boosting the spending of all UI recipients. However there have been some comparatively smaller losses in effectivity, within the type of work disincentive results and UI overpayments.

- UI expansions had been extremely progressive in that they offset earnings losses and delivered probably the most profit to decrease earnings staff.

- The spending impacts of UI had been giant. UI advantages offered a strong stimulus to the macroeconomy by boosting consumption, significantly amongst low-income and low-liquidity staff.

- Work disincentive results from UI advantages had been small throughout the pandemic, particularly when in comparison with historic requirements.

- By the PUA program, Congress elevated entry to advantages and insured earnings losses for staff on the margins of the labor market with out clear proof of better work disincentive results.

- The quickly expanded UI packages confronted a variety of administrative challenges in assembly the surge in demand for advantages, together with delays, pointless purple tape, and overpayments, all of which had been pricey by way of client welfare and authorities expense.

Classes Realized from Expanded Unemployment Insurance coverage throughout COVID-19

UI profit expansions coated labor earnings threat not insured by common UI, warranting consideration of adopting these extra completely or as automated countercyclical stabilizers.

Short-term countercyclical UI dietary supplements may be acceptable, particularly throughout recessions when the danger of long-term unemployment is excessive. Though flat-dollar-amount dietary supplements had been extremely progressive, versatile dietary supplements that focus on a alternative charge doubtless create fewer inefficiencies by way of work disincentives.

UI advantages offered a strong stimulus to the macroeconomy by boosting consumption, significantly amongst low-income and low-liquidity staff.

A key problem that states confronted throughout the pandemic was establishing a completely new program amid peak claims quantity. Thus, conserving a everlasting model of PUA has the necessary advantage of permitting states time to determine protocols and improve techniques to accommodate different populations of uncovered staff throughout non-peak occasions.

Stronger administrative techniques are mandatory for delivering well timed and correct UI advantages at scale in a worker-centered, recession-ready method. On condition that UI performs a key fiscal stimulus position to mitigate a recession, its capacity to ship reduction shortly is important. And but states confronted delays in processing the large surge in UI claims and standing up the brand new PUA program. In response, many states relaxed third-party verification, which resulted in a rise in improper funds.

Versatile dietary supplements require a stronger IT and administrative again finish, nonetheless; IT and administrative shortcomings had been a important barrier to implementing such a coverage throughout the pandemic. Funding in expertise can increase the frontier of what’s doable, enabling states to be extra correct in making funds at a given velocity or to creating funds quicker whereas sustaining accuracy. The federal authorities might present expertise and knowledge infrastructure that might allow not solely versatile profit ranges set at a goal earnings alternative charge, but in addition stronger, extra seamless eligibility verification and fraud prevention.