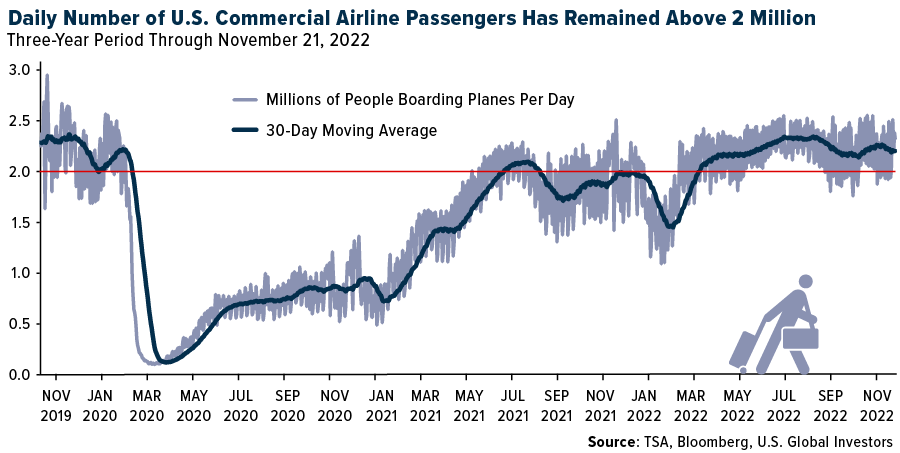

Industrial air journey within the U.S. was extremely strong final week, with passenger volumes topping or exceeding 2.3 million on most days. Thanksgiving was a significant driver of demand, in fact, however there could also be another excuse why vacationers have been in a position to board planes persistently all through the week: distant and hybrid work.

Though most places of work and companies have absolutely reopened following the pandemic, distant and hybrid work stays the norm for hundreds of thousands of American employees, permitting them to avoid wasting each money and time they’d have in any other case spent on commuting.

Working off-site has been an enormous profit to not simply prospects but additionally airways, based on Helena Becker, an airways analyst at Cowen. Any such work “permits [airlines]to be much less ‘peaky’” and permits prospects “to get higher pricing,” Becker says.

Robert Isom shares the identical concept. Talking on the Skift Aviation Discussion board in Dallas, the American Airways CEO mentioned that “demand is extra unfold out” because of the rise in distant work, including that customers, airways and airports are now not “beholden to the construction of the previous.”

This helps clarify why air journey demand was sturdy all through the week as an alternative of it being targeting the times instantly previous and following Thanksgiving Day, as has traditionally been the case. On Sunday, Monday and Friday of final week, extra folks boarded industrial jets than they did on the equal days in 2019, based on Transportation Safety Administration (TSA) information.

What People Have Gained By Working Remotely

Distant work isn’t the proper match for each firm or worker, however the potential advantages are straightforward to see.

In line with World Office Analytics, individuals who work remotely, both full-time or part-time, can save between $2,000 and $7,000 yearly in transportation and work-related prices. They’ll additionally acquire again the equal of two to 3 weeks per 12 months in commuting time. An estimated $20 billion might collectively be saved on the pump.

With places of work now absolutely open, you may suppose that distant and hybrid work is disappearing, however the reverse seems to be true. Gallup, the analytics and advisory agency, discovered that work away from residence really elevated in 2022, accounting for 49% of the U.S. labor drive in June, up from 42% in February. “Totally on-site work is predicted to stay a relic of the previous,” the agency says, although you’re welcome to disagree.

Will “Workcations” And “Bleisure” Substitute Company Journey?

Final week I used to be in Dubai, attending and talking on the Different Funding Administration, or AIM, Summit, and I additionally had the chance to soak up the World Cup in Qatar.

I believe there have been a whole lot extra World Cup spectators who have been additionally combining work and trip (workcation), enterprise and leisure (bleisure).

For the previous 12 months and a half, analysts and the media have questioned whether or not company enterprise journey will ever return to pre-pandemic ranges, as leisure journey has. An October survey of company journey managers within the U.S. discovered that home enterprise journey quantity has returned to 63% of 2019 ranges, whereas worldwide enterprise journey continues to be solely at 50%. Primarily based on present developments, it could take till 2024 or 2025 earlier than company spending on journey has absolutely recovered to pre-pandemic ranges.

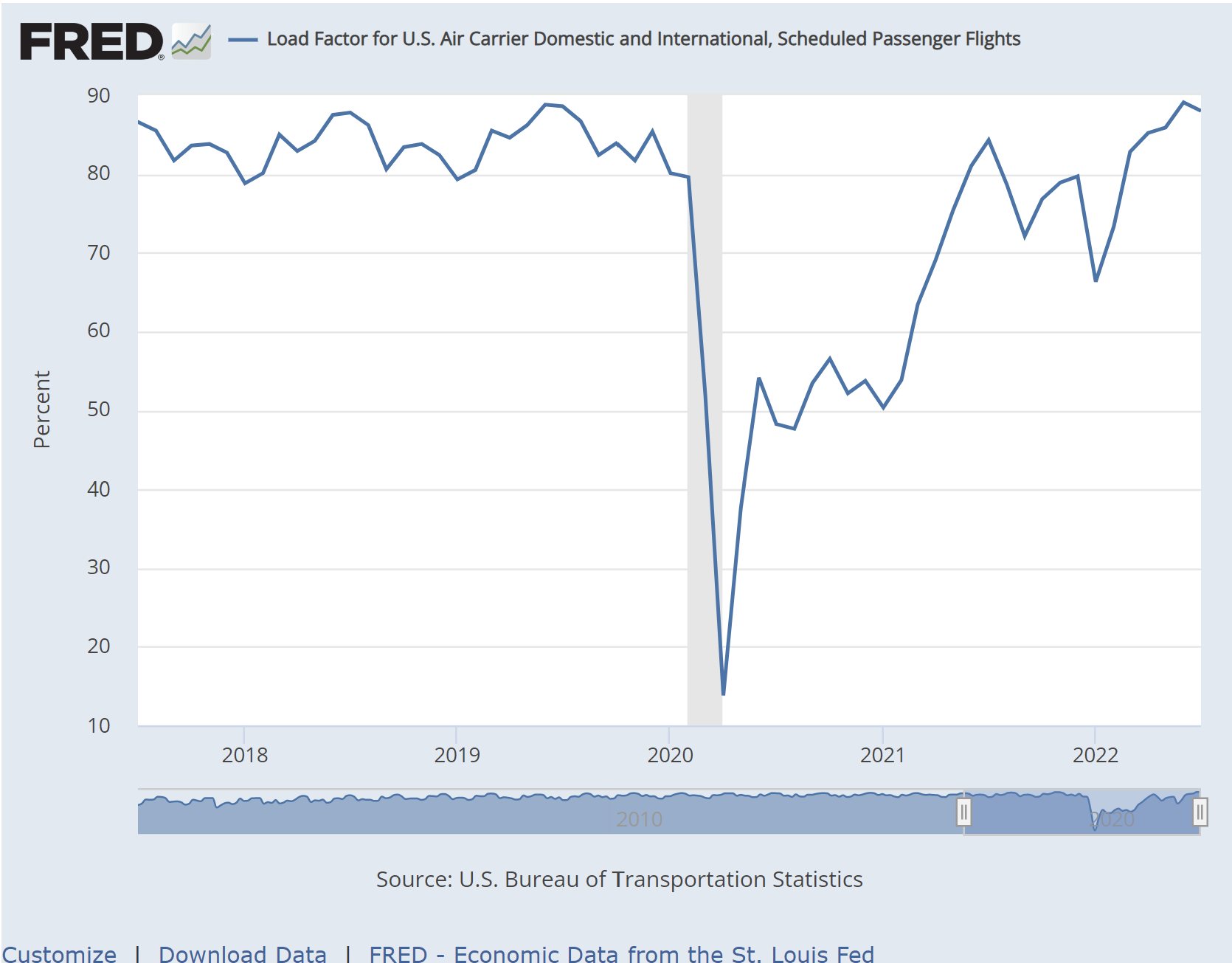

Because of the widespread acceptance of distant work, nonetheless, bleisure journey seems to be changing conventional company journey, if not on a income foundation (enterprise class can value three to 4 occasions as a lot as economic system class) then actually by quantity. Home and worldwide load elements, which measure the seat utilization fee on a schedule flight, have returned to pre-pandemic ranges.

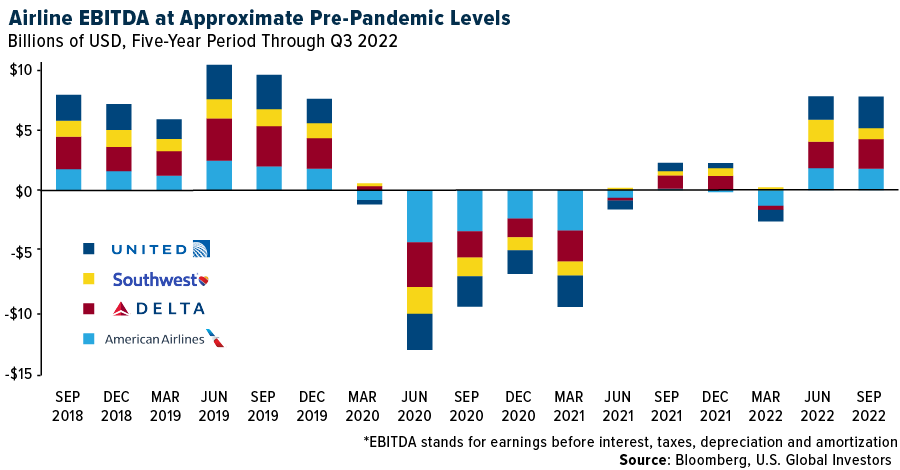

The identical can considerably be mentioned about airways’ profitability. As most of , EBITDA stands for earnings earlier than curiosity, taxes, depreciation and amortization. It tells you the way a lot revenue an organization made earlier than debt and taxes have been paid and earlier than non-cash objects like depreciation and amortization have been factored in.

EBITDA for the Massive 4 U.S. carriers, we see that profitability is nearing pre-pandemic ranges, at the same time as American, United and Delta reported document revenues within the third quarter of 2022.

Decrease Gasoline Prices Would Be A Windfall

As you will have seen, air fares have risen as a result of inflation, however they haven’t risen sufficient to compensate for increased gasoline bills.

The Group of Petroleum Exporting International locations (OPEC), together with Russia, agreed to grease manufacturing cuts in early October, making it much more difficult for crude costs to fall and provides shoppers, together with airways, a break.

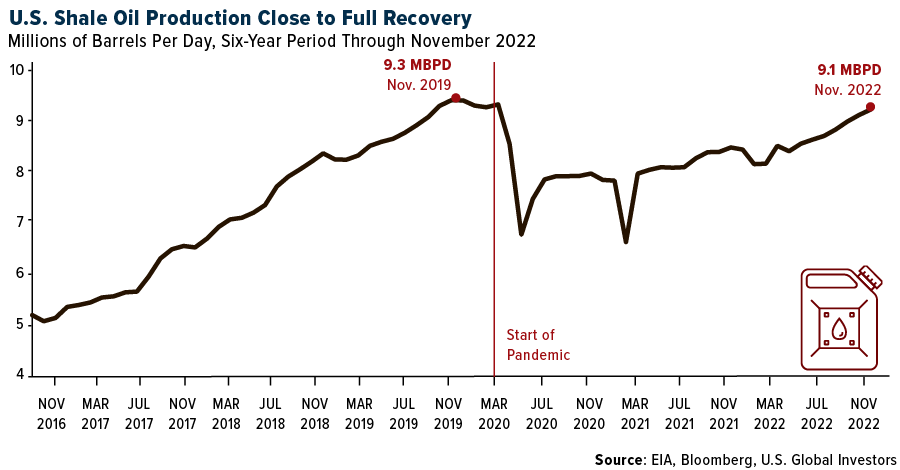

Right here within the U.S., nonetheless, oil manufacturing continues to rise from pandemic lows and is nearing 2019 ranges. Wanting simply at manufacturing from U.S. shale tasks, which ordinarily require fracking to acquire oil, output has elevated for seven straight months via November. This month, some 9.1 million barrels per day (MBPD) are anticipated to have been recovered from the bottom. That’s solely 200,000 BPD lower than the all-time month-to-month excessive of 9.3 MBPD, set in November 2019, quickly earlier than the pandemic.

Jet gasoline accounts for 25% to 35% of an airline’s complete bills, so decrease gasoline prices can be a pleasant windfall. In line with Bloomberg, a brand new airplane pays for itself in 12 years when jet gasoline costs are decrease than $4 per gallon, and as of final Friday, a gallon was $3.18.

Initially published by U.S. World Traders on 28 November 2022.

For extra information, data, and technique, go to VettaFi | ETF Trends.

All opinions expressed and information offered are topic to vary with out discover. A few of these opinions might not be applicable to each investor. By clicking the hyperlink(s) above, you can be directed to a third-party web site(s). U.S. World Traders doesn’t endorse all data provided by this/these web site(s) and isn’t accountable for its/their content material.

Holdings could change every day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. World Traders as of (09/30/22): American Airways Group Inc., Delta Air Strains Inc., United Airways Holdings Inc., Southwest Airways Co.